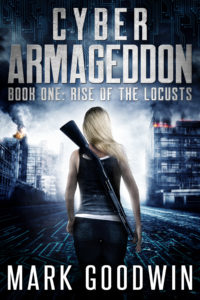

Cyber Attack Cripples South Korea

Cyber Attack Cripples South Korea

Wednesday, South Korea suffered a sever technological blow. Three of their major television networks and two of their major banks were attacked. The cyber attacks against the two banks left some systems completely disabled for more than seven hours. The three television networks were unable to broadcast for several hours as well.

South Korea is no technologically illiterate culture. They were rated number 1 in Cisco’s broadband ranking with 100% broadband penetration. So if it can happen to them, it can happen to us. While 7 hours with out television or banks is far from the end of the world as we know it, it is only an example of what is possible.

Speculators suspect the attack was orchestrated by Pyong Yang, North Korea. This is a country so poor most people do not have electricity that may have been able to affect the infrastructure of a technological power house. If North Korea is capable of spreading such havoc on the most wired Country in the world, what could a more developed enemy do to the United States, who is ranked number 16 in broadband penetration?

The question is worth pondering. Once such an attack occurs, it is too late to make sure you have adequate provisions and cash to make it 7 hours without TV or 7 days with out electricity or 7 weeks with out the banking system.

On Mondays post we looked at the unprecedented move by the IMF and ECB to attempt to persuade Cypress to seize a portion of all bank deposits as earnest money for a bailout of the failing State. The move was set to levy a bailout tax on depositor of 9.9% for those with more than 100,00 euros and 6.7% for those with deposits below 100,000 euros. While the Federal Reserves extorts an equivalent value though inflation annually, such an outright confiscation has not occurred in the modern free world. Simply the suggestion of the move has severely shaken global confidence in banks and fiat currencies alike.

Both cases reinforce our recommendation to keep some assets outside of the banking system. Keeping some cash in a well secured place like a safe is prudent. Of course if there is a currency revaluation or collapse, that may not do you much good. While we don’t give financial advice, we personally keep some level of our assets in gold and silver. I purchase my gold and silver through JM Bullion as they have the lowest price over spot of any company I know of.

If the banking system goes down, don’t expect food to stay on grocery shelves for long. Most groceries are completely paralyzed with out credit card transactions and electric cash registers. Most water companies have generator back up to keep them going for two to three days, but after that you may be on your own. Be sure to have at least a month’s worth of storable food on hand and some method of purifying water. To get prepared for whatever may come, read our 7 Step Survival Plan.

Happy Prepping!

Comments are closed.