Financial Collapse – Threat Assessment Part 2: Global Banking System Meltdown

Financial Collapse – Threat Assessment Part 2: Global Banking System Meltdown

In Financial Collapse Part 1, we wrote about the possibilities of a financial collapse initiated by the consequences of our $16 trillion national debt. As if it were not enough, it is not the only threat facing us with the possibility of triggering a financial collapse.

In my opinion, the problem lies at the very heart of the structure of our modern banking system. When I first took Macroeconomics several years ago, I felt a sudden sense of panic as I learned about the fractional reserve banking system. Had the information not come from a college textbook, I would have likely dismissed the entire reading as conspiracy theory. Until that point in time, I never gave it much thought, I assumed any given dollar could only occupy one space at a given time. That is not exactly the case. Under the fractional reserve system, a bank needs only to retain a percentage of the deposits it takes in.

For an example, let’s say the reserve requirement is 10%. Now let’s say you take $100 and deposit it in the bank. They keep $10 or %10 on deposit and lend out $90 to Bill. Bill buys a new bike from Tom who deposits this same $90 in the same bank. They now keep 10% which is $9 and lends out $81 to Steve who buys an apple cart from Sue. Sue deposits the money into the same bank who again keeps 10% in reserve, $8.10 and lends out $72.90. This goes on and on until the initial $100 has created nearly $900. With the $100 that still belongs to you in your account, that’s $1,000 from $100. But wait that’s not all folks. Do you think Bill and Steve borrowed that money interest free? Not on your life. If those loans were via credit cards, Bill, Steve and the other borrowers are paying around 20% interest. 20% of $900 is $180 in addition to the $1,000. Now we have $1,180 from our original $100.

The alchemist of the 17th century had it all wrong trying to make gold out of lead. They should have been using paper. Not only do we create great amounts of wealth through this process, we also create increasing amounts of debt as interest is added to the principle of each additional loan. The problem is that there is more debt than there are dollars created to repay the debt. In our original example, after all the principle is repaid, and you have withdrawn your $100 dollars, there is still the issue of the $180 in interest outstanding. In a simplified economy where the only money that exists is the $100 and the subsequent wealth created by the fractional reserve banking system, the $180 ends up as a deficit that can not be repaid as there is no money in existence to repay it. Well, you may say, we live in a much more complex economy, we will get the $180 in interest due from another source. Regardless of the complexity , which is part of the problem, not a solution, there is still more debt than dollars to repay.

We have been getting away with this for centuries. It is a fundamentally flawed system that is reliant on ever increasing amounts of debt to sustain itself. Presently, the total global base money supply, also known as M-O is around $8.5 trillion dollars. M-O or base money is all of the money in circulation and all the money on deposits at banks. Total global bank assets, also known as loans are near $100 trillion. This $100 trillion is wealth magically created from the $8.5 trillion. It is also earning interest and by nature, creating more debt every day. To create $100 trillion from $8.5 trillion means the banking system is leveraged 12 to 1. This is highly leveraged and increasing overall volatility by the minute. What we have developed is an amazingly tall house of cards. The wealth created is not real.

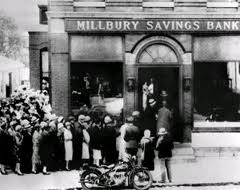

What could possibly go wrong with this system? We already have that answer. We got it here in America in 1929. In a fractional reserve banking system, credit expansion is always followed by credit contraction. We know how bad it was in the great depression, what we don’t know is how bad it will be with a $91.5 trillion ($100 tr – $8.5 tr) credit contraction.

That can’t happen again. We have the FDIC. That’s right, they have safely managed to sock away $13.6 billion. US base money is approximately $1.7 trillion and total US bank assets (loans ) are around $20 trillion. So, if there is a bank run, they have the first .068% of it totally covered. I know I’ll sleep better tonight. Thanks FDIC! It is like trying to put out a forest fire with a squirt gun.

The $13.6 billion in the FDIC insurance fund is just there to make you feel safer. It is sort of like a 6 year old who feels quite well defended against any would be intruder as long as he has his trusty Red Rider BB gun. If there ever is an intruder, his confidence will fail rather quickly. In the same way, someday a market crisis will invade our happy illusion and confidence in the FDIC will fail. We will experience bank runs like we have seen recently in Spain and Greece. We will see lines at the banks around the block like we saw in the depression. The FDIC will have no choice but to declare a bank holiday, which has nothing to do with eggnog or turkey dinners.

If we experience this type of banking collapse, the only money you will have access to will be what you had before the bank holiday. Most likely, credit cards will not be accepted during this time. We recommend keeping a minimum of one month total expenses in cash in a secure location in your home. You can read our detailed 7 Step Preparedness Plan to better prepare yourself for the coming storm. To learn more about fractional reserve banking and our debt based monetary system, watch Money as Debt.

Happy Prepping!