Marc Faber Interview- Financial Survival

Marc Faber Interview

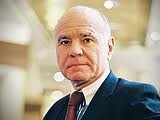

Dr. Marc Faber is an investor born in Switzerland and the publisher of The Gloom, Boom and Doom Report. He holds a PhD in economics and serves as a director or an adviser on several investment funds.

In this interview with One Radio Network, Marc Faber discusses several threats to our economic future. Dr Faber speaks a bit on the role of the Federal Reserve. He says that the attempt by the Fed to prop up the housing market will not be as successful as they anticipate. The Fed creates liquidity by constant quantitative easing which is electronic money printing. Once the liquidity has been created, there is no way to insure the money flows into the intended direction. In fact, much of the money has been flowing back into United States treasuries. This creates an unintended consequence of a treasury bubble.

Marc Faber goes on to comment on what he perceives to be a derivatives bubble. Several commentators have estimated the world derivatives market to be between $400 trillion and a quadrillion. Just when I got my mind around a trillion, I have to mentally digest a quadrillion. Traders will tell you that despite its size, the derivatives market poses no threat to our financial system. They will tell you that it is a zero sum game, meaning that for every $1 bet that a derivative will go up, there is a counter $1 bet that it will go down. Before 2008, we may have blindly believed them. In 2008, we learned that mega insurance agency AIG was writing Credit Default Swaps for much more downside risk than what they were able to cover. Since this act was considered by regulators to be mispricing of risk rather than criminal, they were bailed out rather than locked up. Since they were bailed out, the lesson learned was ” lose all the money you want, we’ll print more.” The free market has been prevented from being able to bring about the creative destruction that needs to occur in order to clear out bad investments to make room for the good. Now we have a derivatives time bomb that threatens to dwarf the 2008 crisis.

Mark Faber gives some good recommendations about protecting yourself from market volatility. He recommends diversity and hard assets as the future is so uncertain. Marc Faber has long been a believer in owning gold to manage risks from inflation and currency collapse.

Leave us a comment and let us know what you thought of the Marc Faber interview. Also let us know your favorite financial advisers.

Happy Prepping!