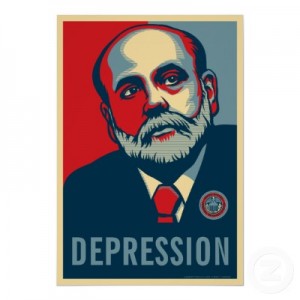

QE 4 Shows Bernanke’s Desperation

QE 4 Shows Bernanke’s Desperation

Wednesday, Ben Bernanke announced the Federal Reserve will be purchasing an additional $45 Billion in U.S. Treasuries per month. Those purchases are made through money that is simply created out of thin air by the Federal Reserve. He stated the the current monetary policies would stay in place until we reached an unemployment rate of 6.5%. Chairman Bernanke stated that the Fed expected the unemployment rate to remain above 6.5% until 2015. While rates may reach that forecasted level, it would only be due to low work force participation rates which lower the published employment numbers. The reality is, the Fed is most likely stuck in a death spiral of pumping more and more liquidity into our economy.

QE 4, The latest round of Quantitative Easing comes only a few months after the last announcement of QE 3 in which the Fed announced they would be purchasing $40 Billion in mortgage backed securities. Combined, they total $85 Billion per month and $1.02 Trillion ($1,020,000,000,000.00) per year. Even with the zeros, it is hard to grasp what a large amount of money that is. Spending at the rate of $1 per second, it would take you 11 days to spend $1 million dollars. If you had started spending at the rate of $1 per second in 29,000 BC, you would still have money left today. The US government manages to spend $1 trillion every few months, and they still want more. No amount of tax increases will ever satisfy the insatiable appetite of our Federal government.

Our economy is now addicted to constant injections of more and more liquidity. Like a heroin addict, it gets less of a high with each new dose of the drug. Markets soured today despite the indefinite promise of a constant drip of fiscal dope. To cut the supply of the drug to the economy would send it into traumatic withdraw at this point.

How dose this affect me?

This new $1 trillion being pumped into the economy each year increases the money supply. The current M2 money supply in the U.S. stands around $10 trillion. Current money printing programs by the Fed increase that number by 10%. Austrian economist will tell you that equates to 10% inflation. Even if it doesn’t show up in prices right away, it will eventually. Let’s think of it like this. We have a simple economy that only has 10 pizzas and $10 dollars. Theoretically, each pizza is worth $1. Now if we bring the money supply up to $11, theoretically, each pizza is now worth $1.10. That is 10% inflation. This is a stealth tax on US tax payers. Because of the excessive money printed by the Fed to buy our own debt, you can expect prices on everything from a Ferrari to fried chicken to increase by 10%.

This creates a flaw in the function of money. Money has two basic functions. It acts as a medium of exchange and a store of value. While the medium of exchange function is still working well, the store of value function is broken at these levels of inflation. Let’s think of the dollar as a Styrofoam cup filled with coffee. The cup being the dollar and the coffee being the value being held by the dollar. QE 4, like all of the QE before it has essentially poked a hole in our coffee cup. The coffee is running out and soon we will be holding an empty Styrofoam cup with no value at all.

The further threat is that as this money begins to work its way into the banking system, it will grow exponentially. This has the potential of getting out of the control of the Central bankers and creating hyperinflation that could cripple the dollar and collapse the economy with it.

What do I do to keep from loosing all of my value?

The logical thing is to pour your coffee into a cup that doesn’t have a hole in it. For dollars, that means hard assets. While our increasingly volatile markets leave very little in the way of certainty, there are a few bastions of safety relative to the dollar. I personally like gold, silver and real estate as protection against this inflationary environment. Even if values go down, a house is still worth a house. Gold and silver have been considered stores of wealth for thousands of years. In The Bible, Genesis 13 says Abraham was wealthy in livestock, silver and gold. By contrast, the dollar in its current purely fiat form has only been around for 41 years. I have dishes older than that. The dollar was completely divorced from gold in 1971. Ever since, it has only been backed by the full faith and credit of The United States government. At a whopping $16 trillion in debt, I don’t have full faith in the credit of The United States. Unfortunately for the dollar, I am not alone in my opinion.

I mention my investment strategies from time to time. I currently hold a degree in Accounting and am persuing a degree in Finance, however, I am not a financial adviser and I don’t make specific recommendations on these posts. Everyone’s situation is different and therefore everyone’s investment style is going to be different. Before investing in any instrument, you should fully understand the instrument and the risks associated with it. All investing is inherently risky and can lose money.

The following video from Capitol Account gives an incredibly accurate take on the reasons and repercussions of the latest Fed move. Check it out and keep prepping. This move is a sign of desperation by the Fed. I think they know our time is short.

Jim Rickards on Capitol Account

Happy Prepping!

Doing the same thing over and over again and expecting different results? We all know what that means!