Treasury Admits They Are Out of Money- Is TEOTWAWKI at Hand?

Treasury Admits They Are Out of Money and Tricks.

Last week, Treasury Secretary Jack Lew said the Treasury will have exhausted all of their “extraordinary measures” on October 17th. The United States debt stopped just shy of the debt ceiling back around May 17th. Since then, the Treasury has been digging change out of the couch to keep the habit going. They have taken a dividend from Fannie Mae and Freddie Mac, they have stopped rolling over “investments” in the Exchange Stabilization Fund and they have borrowed the few dollars they could from The Civil Service and Retirement Fund. Come October 17th, all the pennies will have been rolled up and the borrowing, scraping, delaying and finagling will hit a wall.

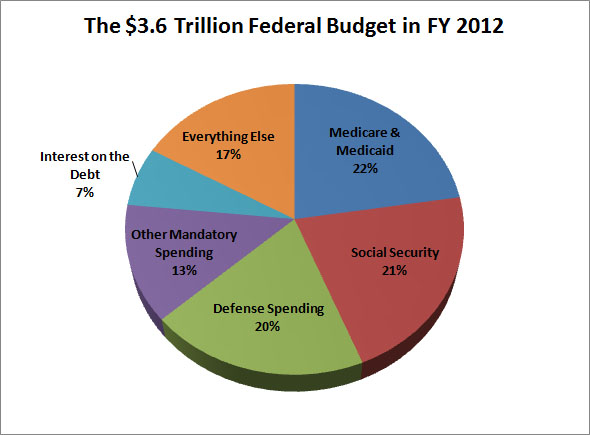

So is this a big deal? You bet it is! We are talking TEOTWAWKI if some agreement is not met by October 17th. The US will default on some of its obligations. I don’t think the US would default on their debt payments, as that is their life blood that sustains their profligate lifestyle. So where will they make the cuts? Let’s look at a US Government spending chart to try to get an idea.

First let’s look at the revenue we are actually bringing in. It is roughly $2.5 trillion. That means we are short just over $1 trillion dollars on our current spending or just over 30%. So if we don’t raise the debt ceiling, theoretically, we would need to cut everything by 30%. Wow, it actually sounds like a good idea. Unfortunately, it is not possible.

OK, just for fun, what would we cut? Well Medicare and Medicaid are out. Folks on those programs have paid into this system their whole life. Same story with Social Security. Those two programs make up 43% of the entire budget. The 7% going to service the debt is also untouchable. Now we are already at half of the entire budget that can’t be touched. That means 30% just became 60% of everything left.

OK, what would happen if we cut 60% out of the Federal Supplemental Nutritional Assistance Program or SNAP? Funny you should ask. I have a couple of chapters in my new dystopian fiction book, American Exit Strategy dedicated to that scenario. Long story short, the cities descend into chaos. While it is a fun read, it is nothing anyone would want to live through.

To cut $1 trillion out of our federal budget in one big cut would send shock waves through our economy and trigger the end of the world as we know it. My recommendation would be for Tea Party conservatives to raise the debt ceiling limit just enough to get us one more year and tie 5% annual budget cuts that would cut the federal budget to a sustainable level over the course of the next 6 years. I would use subsequent debt ceiling increases to gut the federal government to half of its present size over the next 15 years.

The Tea party conservatives have the upper hand in this game. Their constituents are typically not dependent on government spending as the welfare class that keeps the Democratic party in power, nor the government contractors and military industrial complex that keeps the RINO, Neo-con Republicans in power.

Other than the initial shock wave, a refusal to raise the debt ceiling would be exactly what Constitutional Conservatives like myself would like to have. So encourage your Representatives to stand firm on the up coming debate. We have the Democrats and the Neo-Cons over the proverbial barrel. I guarantee that Obama will negotiate on this one. It is only up to us to let the patriots representing us in Congress, like Rand Paul, Ted Cruz and Justin Amash, know that we will stand behind them, no matter what, if they will stick to their guns.

On another note, the past debt ceiling debates have been very bullish for gold and silver. No matter the outcome, the dollar will likely take a hit and gold and silver will be viewed as safe havens. If the debt ceiling is raised, that means more money printing which devalues the current dollars in circulation. That is bullish for gold. If the debt ceiling is not raised, the US will default on 30% of its obligations until those obligations are brought into alignment with our current revenue. That will completely erode any confidence that remains in the dollar and gold, in dollar terms at least, will sky rocket! I personally try to keep some portion of my long term wealth in gold and silver. I use JM Bullion as they have the lowest over spot price that I know of. Shop around, you will probably find they have the lowest prices as well.

If you aren’t prepared yet, it is time to get with the program. If you don’t have a program, read my 7 Step Survival Plan. It is a blue print for getting prepared on a budget. It even has several companion podcasts with some of the steps that you can download and listen on the go.

Happy prepping!

MDG

Comments are closed.