Special Edition Broadcast-7 Step Survival Plan – Prepper Recon Interview on Midnight Patriot

I was on the The Midnight Patriot last week for my first interview. It was quite an experience being the one in the hot seat for a change. Fortunately, I had a very gracious host interviewing me. Jeff Norton has a great show going every weeknight from 10:00 EST to 12:00 EST. You can check it out any night Monday thru Friday at TheMidnightPatriot.com. If you cannot listen live, the shows are available the next day to download from his Spreaker feed at the top of The Midnight Patriot web page.

Podcast: Play in new window | Download

In this interview, I give an abbreviated run down of the Prepper Recon 7 Step Survival Plan. I say abbreviated, but the interview actually runs for over an hour. I hope to go back on the The Midnight Patriot on Thursdays to give a more in depth presentation of each of the 7 Steps.

We talked a bit about Step 1 in the interview which is Body, Mind and Soul. You are your number one survival tool, so you have to take care of all the aspects of your being.

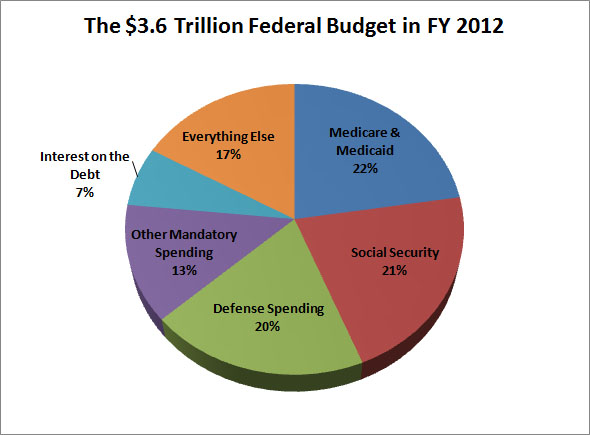

Then we talked about Step 2, which is Budget. So many preppers create there own personal SHTF experiences by not getting in control of their money.

Step 3 in my plan is the Bug Out Bag. I give a few quick tips on what you should put in your bag to sustain you for 72 hours.

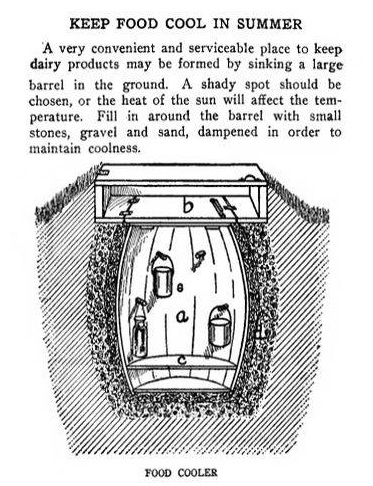

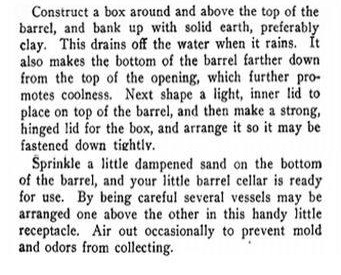

Next is Beans. I explained a few things folks can do to get some basic long term storage food for under $20. We also talk about storage methods.

Once those area are taken care of we can move on to Bullets. Step 5 is all about defending your home and your family.

Then we talk about long term wealth preservation. Silver and Gold may or may not be used as barter items during the collapse, but when the smoke clears, I think it will have proved to be an excellent form of wealth protection. Bullion is Step 6.

The final step in my 7 Step Survival Plan is Bug Out Location. You should be thinking of where you can go if you have to evacuate your present location for any reason.

Listen to the interview, I think new preppers will learn a lot and seasoned prows will be reminded of the basics. It was a fantastic experience for me to be on the show and to get back to the basics of prepping, because prepping is all about the basics. Make sure you stop by TheMidnightPatriot.com to listen live on Weeknights or download the podcasts the next day.