Blue Storm: Financial Hurricanes Striking Blue States

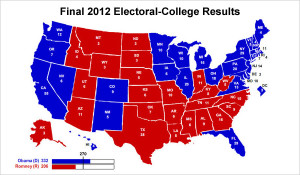

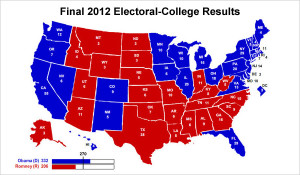

The states who are in the worse financial shape, coincidentally (or not) are also among those who helped maintain the current administration in Washington. We compared maps of the states who supported president Obama in 2012 with those facing the most sever financial crisis. The map above show the final count for Obama in blue, and those who voted against Obama in red. I say “against Obama” because many conservatives found Romney to be the poorest possible Republican candidate and only cast their ballot for him because he was not Obama.

In the map below, I have placed bankruptcy icons in both the top ten states with the highest debts and the top ten states with the highest deficits. If you compare the maps, you see most of the icons are in the blue states. 9 out of ten of the highest debt states were Obama supporters in 2012. Likewise, 7 out of 10 of the states running the highest deficits were also Obama supporters in the same election.

Debt and Deficit Map

The average correlation of debt and deficit to states that supported Obama is 80%. (70% for deficit and 90% for debt). The evidence seems to show that the economic model those states subscribe to is similar to that of the President. Those failing states represent people who embrace the failing policies of our failing president. Many of these states are notorious for wasteful and welfare spending. We also notice that California and New York are recipients of an icon for both debts and deficits. These two states have long been havens for liberals and socialism. Governor Cuomo and Mayor Bloomberg are each doing their part to make sure New York State and New York City are among the most oppressive locations in America. Governor Cuomo recently placed a ban on all gun magazines with the capacity to hold more than 7 bullets. Mayor Bloomberg did his part by restricting the size of soda that you can order with your pizza.

Corresponding Chart for Debt and Deficit Map

| Rank |

Worst Deficits |

Worst Debts |

Worst Unfunded Benefit Liabilities |

| 1 |

Arizona |

Massachusetts |

Ohio |

| 2 |

California |

Connecticut |

Wisconsin |

| 3 |

Nevada |

New Jersey |

Alaska |

| 4 |

Illinois |

New York |

Illinois |

| 5 |

New Jersey |

Illinois |

Alabama |

| 6 |

New York |

California |

New Jersey |

| 7 |

Rhode Island |

Wisconsin |

South Carolina |

| 8 |

Kansas |

Maryland |

Colorado |

| 9 |

Oregon |

Louisiana |

Connecticut |

| 10 |

Alaska |

Florida |

Minnesota |

In addition to your lack of freedom for living in these economically unstable states, New York and California also have some of the highest state income tax rates as well. New York’s top rate is 8.82%. California’s top tax rate is 13.3%. in contrast, Texas made neither list for debt, deficit nor voting for Obama. So to be in such good financial condition, Texas must really collect a lot in state income tax. The Texas top state income tax rate is 0%. That’s right, ZERO! Why would some one stay in New York or California? Many people are asking themselves the same question.

Let’s look at an example. A big earner who makes half a million in California could get a raise of $66,500 per year by moving to a state with no state income tax. That is about $1 million every 15 years. The only downside is he would have to decide for himself how much soda to drink and how many bullets he should have in his gun, because Texas doesn’t make those decisions for you.

The more a person makes, the bigger the incentive for them to move. Free market economics suggest that all but the most ignorant of high income earners will move. They will find states that treat their money better, even if they don’t like the notion of freedom. This shift will leave states like New York and California in a still more detrimental situation. Having lost the bread winners, they will be stuck with only those they have trained to be dependent on the welfare state. Unable to leave, the welfare dependents of those states will consume the vital resources needed to keep the state governments afloat. At some point, the Federal government will no longer be able to bail out those states, and they will collapse into chaos.

Even a state like New York is only so liberal in her highest population centers. A map showing outcomes of the 2012 election by county shows most of New York, by area, supported Romney. However, the electoral college is determined by population, not area. Take a look at the map below. You will notice that even Illinois, a leftist mecca, is mostly conservative outside of the population centers.

2012 Presidential Election results by County

In the event of of a economic collapse which destroys society as we know it, most of the die off will occur in the areas with the highest population density. On our map, we see most of those areas are blue. Those living in more rural areas would be better prepared to hunt and farm in order to feed themselves. The die off would be a fraction of what would occur in the cities. Most of rural America is represented on the map as being conservative. America is not lost. It is just the a few spots on the map that are lost. Unfortunately, they are running the show for now.

If you live in these areas, now is the time to start planning your exit strategy. Once the trend starts of people moving out of these areas, housing values will sink quickly. I don’t think things will fall apart over night, but have a place to go just in case they do. The very nature of the future is unprecedented. No one knows exactly what will happen or how fast. Making a move towards a more free state is , in most cases, also making a move to a more stable state.

We cannot ignore the impact of a $1 trillion dollar annual military budget on our Federal deficit. I know it was not the Democrats welfare programs alone that ran up our $16.6 trillion dollar Federal deficit. The Warfare budget has been treated as a sacred cow by the Neo-Conservative element that has hijacked the Republican Party. Don’t forget your history. The Republican Party was born out of the ideas of Thomas Jefferson. Those who fell in the camp of smaller government, individual freedom and minding our own business internationally were first called Jeffersonians. They latter became known as Republicans. We don’t need a new party, we need to take our party back!

Don’t give up. Keep taking steps toward defending your liberty. Don’t let the Democrats bully you out of your county and don’t let the Neo-Cons bully you out of your party! Speak your mind, know your history, stick to your guns, defend your constitution and keep prepping. It will get worse before it gets better, but all is not lost. If you are not prepared for what is coming, now is the time to get your plan together. Read our 7 Step Survival Plan to get ready for whatever may come. It will help you prepare for everything from a hurricane to the end of the world as we know it.

God bless you and keep you and happy Prepping!