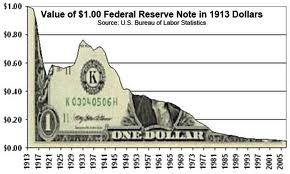

Timing TEOTWAWKI-The Collapse of The Dollar

Timing TEOTWAWKI- The Collapse of The Dollar

A growing number of economist are willing to admit that the dollar is on life support and the life support is running on back up power. Among those is John Williams. He is the creator of Shadowstats.com. Shadowstats.com tracks economic data collected and reported by the US government, then corrects the manipulation and reports the numbers to more closely reflect reality. In this recent interview with Greg Hunter of USAwatchdog.com, John Williams said the real federal deficit for 2012 was closer to $6.9 trillion dollars as opposed to the $1.1 trillion that has been reported. Shadow Stats uses GAAP (Generally Accepted Accounting Guidelines) that would, by law, have to be used by any corporation in America to arrive at the $6.9 trillion number. This number includes unfunded Social Security and Medicare liabilities that were taken on in the past year with no means of paying those liabilities. His full Special Report on Hyperinflation 2012 is available to read on line. As Mr. Williams points out, the only way to pay for the continued deficit spending is by new money creation. As we continually add more money to the supply, it competes for the same amount of goods and services. This is inflation. John Williams expects this inflation to begin to show up as dramatic price increase within the next 4 months. He expects that we will see Hyper inflation by the beginning of 2014.

John Williams Interview on USAWatchdog.com

Germany Wants Gold Being Held by The Federal Reserve

Another sign of the demise of the dollar is the recent news that Germany is seeking to repatriate the German gold being held by America. The Germans are seeing the crack in the veneer of the reserve currency of the world. They have requested that more than 600 tons of gold be returned to Germany. The US response was that the gold would be returned by 2020. This has sparked speculation as to whether or not the gold is actually where it is supposed to be. The gold should be available to be returned with in months of a request rather than the 7 year time frame that was given. This has also been a cause for concern to other nations that keep gold on deposit in America. If it turns out that there has been misappropriation of the gold by America, the gold will have to be repurchased. This would drive up precious metals to new highs. If you have been putting off your purchase of precious metals, your time to get in at current levels may be running short. I purchase all of my precious metals through JM Bullion. They have the lowest price over spot for both gold and silver.

Happy Prepping!